Providing security and peace of mind for you, your family and your business

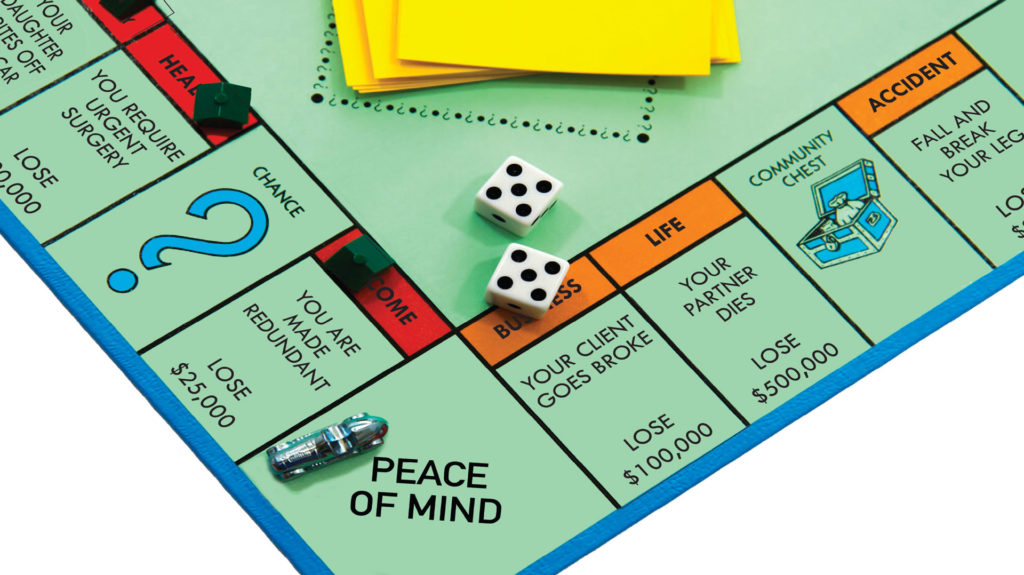

Life should not be a game of chance! Unfortunately, however, many people still treat life like a game of monopoly and see their family’s future effectively being determined by the roll of the dice, without a protection plan to deal with the unexpected challenges that life can present.

Life’s protection plan

Having a contingency plan in place for those tough financial times that may arise owing to sickness, accident or losing a loved one, is one of the smartest and wisest decisions that you will ever make.

But where to start, as it can all be a bit daunting, confusing and scary. With so many product and premium options, insurance providers and variables to consider, there is substantial benefit in working with an experienced insurance adviser to guide you through the maze of options and arrive at the best-tailored plan for you, your family and your business – at an affordable cost.

So how can you manage or eliminate some of life’s risks?

- Firstly, if you do not have any life and health insurance, sit down with an experienced insurance adviser and map out a suitable protection plan to manage your risks and exposures.

- Secondly, make sure your insurances are up-to-date on a regular basis. Consult with an expert adviser every time there are material changes in your life situation and/or business.

- Thirdly, become familiar with UProtectNZ’s Six Universal Rules of Life and Health Insurance (these are in the February 2019 issue of the Millwater Mag or email theo@uprotectnz.com for a free copy). These are universal “rules” that have been identified by UProtectNZ, drawing from our extensive experience, that apply to life and health insurances. Follow those six rules of life and health insurance, and you can expect to Have A Sound Protection Plan In Place.

Engaging a specialist insurance adviser is one of the best decisions you’ll ever make.